Oracle Enterprise Performance Management (EPM) Cloud

Oracle has played an important role in the CPM market since taking over the Corporate Performance Management (CPM) specialist Hyperion in 2007. The solutions for consolidation (Hyperion Financial Management) and planning (Hyperion Planning) were already widely used before the takeover and were popular with medium-sized companies and large corporations worldwide. With the digital transformation in the finance departments, Oracle is one of the first major providers in the CPM market to adopt a "cloud only" strategy. In this context, the new Oracle EPM Cloud was created, which is offered as a pure Software as a Service (SaaS) solution.

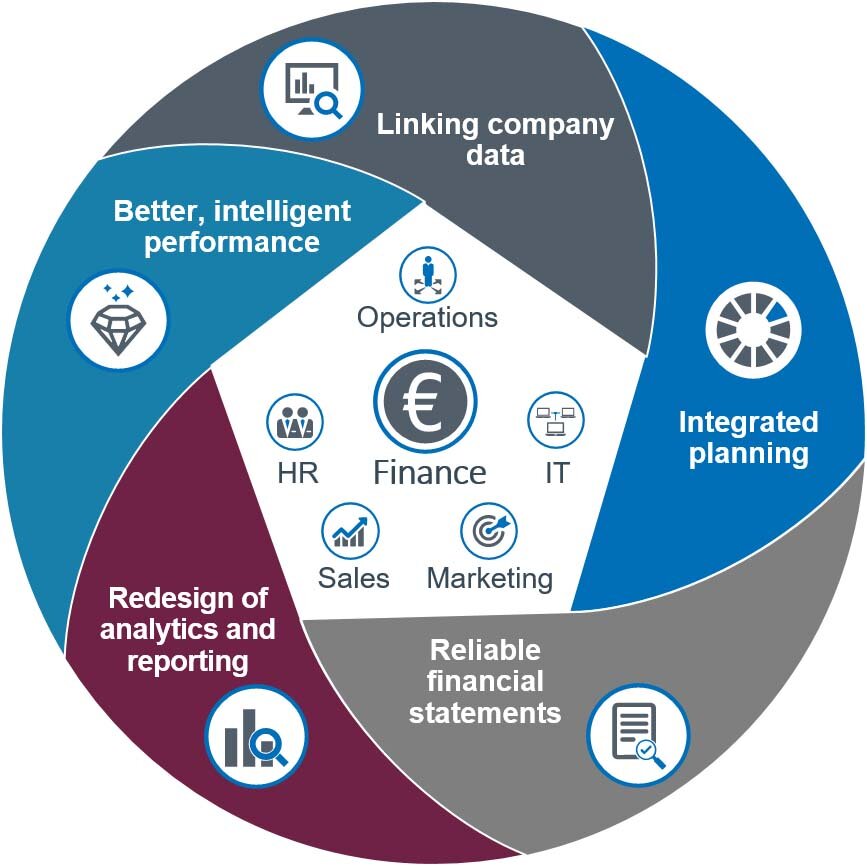

Oracle EPM Cloud - The comprehensive CPM solution for the finance function

Within the EPM cloud, Oracle bundles a large part of the financial processes that could previously only be mapped in separate CPM tools. The CPM platform enables the individual finance functions, such as Group Accounting, Controlling and Tax, to work in an integrated manner, to leverage synergies and to create a data pool for all functions. Various options are available for reporting, with which both interactive dashboards and print-ready pdf reports can be created. For office integration, the SmartView module is used, which enables frictionless integration with Word, Excel and PowerPoint. New developments in the areas of Robotic Process Automation (RPA) and Machine Learning can be made available at short notice due to the SaaS model.

For comprehensive financial closing with CPM solutions

The processes of financial consolidation already benefits from process automation capabilities. The integrated closing calendar makes it possible to both control and automate the processes, starting with the closing of the general ledger and ending with the creation of the final reports. In an upstream process, the complete account reconciliation including inter-company (IC) matching can be performed with the Oracle EPM Cloud. Users benefit from the platform's intelligent, constantly evolving functionalities (machine learning).

Data Management enables the integration of pre-systems data. Any pre-system can be connected, allowing for data mapping and uploading. This process it completely automatable. The consolidation itself is highly standardized, but also offers the possibility to customize logics.

A great benefit of the Oracle EPM Cloud is the direct integration of the tax processes into financial closing. Predefined input masks and logics allow the calculation of current and deferred taxes, both at company and group level. The tax reconciliation is automatically derived from the previous calculations.

The last steps in the closing process can also be performed directly in the platform. A module is available for the creation of the final reports in order to transfer data from the database directly into the report. This represents an enormous reduction in risk and time expenditure, especially for last-minute adjustments. Special reporting requirements such as ESEF reporting can also be covered by the Oracle EPM Cloud.

Integrated planning with the Oracle EPM Cloud

Besides the closing process, integrated planning represents the second important pillar within Oracle's EPM cloud. The solution offers pre-configured modules as well as high flexibility to map your own planning processes. So-called planning frameworks are available for financials, projects, workforce and capital. Out-of-the-box contents are already provided, such as:

- Drivers and KPIs

- Calculation logics

- Entry forms

- Reports and dashboards

Different approaches can be chosen for the planning process:

- Driver-based: Using main drivers to calculate the operational and financial accounts

- Trend based: Using historical trends to map the future

- Predictive: Using statistical algorithms to represent the future based on historical data

- Manual input: Manual input of planning figures

In particular, predictive planning will be extended in the future and become increasingly relevant for companies.

Transfer Pricing: Calculations and documentation requirements

Issues relating to transfer prices are increasingly relevant. Oracle EPM Cloud offers solutions for the whole transfer pricing process. Transfer prices can be calculated automatically with the help of predefined logics and enhanced with additional imported external data. Outputs are stored in the ERP system.

The monitoring and adjustment process is 100% automatable. During the year, an automated upload from the ERP systems into the Oracle EPM Cloud occurs. This includes all IC transactions and the corresponding detailed information. Based on this data and the stored forecast, the necessary adjustments to the individual transfer prices are calculated and the adjusted transfer prices are transferred to the ERP systems. At the end of the year the system finally determines the necessary debit and credit notes, which are also transferred to the ERP systems.

Based on the existing data within the Oracle EPM Cloud, documentation can also be carried out via the platform. Predefined masks are available for country-by-country reporting. The XBRL document can also be created directly. In addition, the module offers a good platform for the generation of master and local files for the creation of the final reports.

Centralized master data management

A data management module is available to manage master data centrally. Using a predefined approval procedure, the requirements are checked and specified. If the approval procedure is successful, the adjusted master data is then automatically transferred to the individual modules.

Leveraging emerging technologies on one single platform

- Robotic Process Automation: Oracle offers many possibilities for automation, in specific processes triggered by the closing timeline.

-

Machine Learning: Machine Learning is utilized for account reconciliation in order to successively increase the degree of automation among others.

-

Human Interface: Oracle is increasingly relying on bots to make requests to the EPM cloud. This means, for example, that data assessments no longer have to triggered by the user.

The platform (SaaS) allows constant adaptation with new technological possibilities and will be continuously expanded by Oracle.

Oracle EPM Cloud - Comprehensive, Integrated, Intelligent

Overall, the Oracle EPM Cloud is one of the most comprehensive solutions on the market for Corporate Performance Management solutions.

Finance processes are widely covered (End-to-End) and can be deployed in a fully integrated way. With the help of emerging technologies, the platform is constantly evolving and thus guarantees a state-of-the-art solution.

As an Oracle partner, we are always available to answer your questions about Oracle's CPM solution and live demos.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!